Bagley Risk Management Solutions: Your Guard Versus Unpredictability

Bagley Risk Management Solutions: Your Guard Versus Unpredictability

Blog Article

Recognizing Livestock Risk Protection (LRP) Insurance Coverage: A Comprehensive Guide

Navigating the realm of livestock threat security (LRP) insurance coverage can be a complex endeavor for lots of in the agricultural sector. From how LRP insurance works to the different insurance coverage choices offered, there is much to discover in this extensive overview that can potentially form the way livestock producers come close to risk administration in their businesses.

Just How LRP Insurance Coverage Functions

Periodically, recognizing the mechanics of Animals Threat Defense (LRP) insurance can be complex, yet damaging down how it functions can offer clearness for farmers and breeders. LRP insurance coverage is a risk administration tool developed to protect animals manufacturers against unexpected price decreases. The policy permits manufacturers to set a coverage degree based upon their details needs, picking the number of head, weight array, and insurance coverage rate. As soon as the plan remains in location, if market value fall listed below the protection price, producers can sue for the difference. It's essential to note that LRP insurance policy is not an income guarantee; instead, it concentrates only on cost danger defense. The protection period commonly varies from 13 to 52 weeks, supplying adaptability for producers to pick a period that lines up with their manufacturing cycle. By utilizing LRP insurance, farmers and ranchers can mitigate the monetary risks associated with fluctuating market value, guaranteeing better security in their operations.

Eligibility and Protection Options

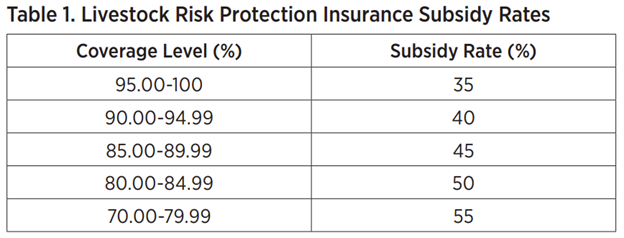

When it pertains to protection choices, LRP insurance coverage offers manufacturers the versatility to pick the insurance coverage level, insurance coverage period, and endorsements that best fit their danger monitoring demands. Coverage degrees typically range from 70% to 100% of the anticipated ending value of the insured animals. Producers can likewise pick insurance coverage durations that align with their production cycle, whether they are insuring feeder livestock, fed livestock, swine, or lamb. Endorsements such as cost danger defense can further personalize coverage to safeguard versus unfavorable market fluctuations. By comprehending the qualification requirements and protection choices readily available, animals producers can make informed decisions to handle risk successfully.

Benefits And Drawbacks of LRP Insurance Coverage

When examining Livestock Danger Protection (LRP) insurance policy, it is essential for animals manufacturers to consider the disadvantages and advantages integral in this danger monitoring tool.

One of the main benefits of LRP insurance is its capacity to give defense against a decrease in livestock costs. In addition, LRP insurance supplies a degree of adaptability, permitting producers to tailor protection degrees and plan durations to fit their certain needs.

However, there are additionally some drawbacks to think about. One restriction of LRP insurance policy is that it does not shield versus all sorts of risks, such as you can try here illness episodes or natural catastrophes. Additionally, premiums can in some cases be costly, specifically for manufacturers with large livestock herds. It is vital for producers to very carefully analyze their specific danger direct exposure and monetary scenario to establish if LRP insurance policy is the right risk monitoring tool for their operation.

Comprehending LRP Insurance Premiums

Tips for Taking Full Advantage Of LRP Conveniences

Taking full advantage of the advantages of Animals Danger Defense (LRP) insurance calls for tactical planning and positive danger administration - Bagley Risk Management. To maximize your LRP coverage, think about the following suggestions:

On A Regular Basis Analyze Market Problems: Keep educated concerning market fads and price fluctuations in the livestock sector. By checking these factors, you can make informed decisions concerning when to acquire LRP insurance coverage to shield versus potential losses.

Set Realistic Coverage Degrees: When picking coverage degrees, consider your manufacturing expenses, market price of animals, and prospective risks - Bagley Risk Management. Setting reasonable coverage degrees makes certain that you are sufficiently safeguarded without overpaying for unnecessary insurance

Diversify Your Coverage: As opposed to depending solely on LRP insurance coverage, consider diversifying your danger management techniques. Combining LRP with various other danger administration devices such as futures agreements or alternatives can offer thorough coverage versus market uncertainties.

Review and Adjust Insurance Coverage Regularly: As market problems change, periodically assess your LRP protection to guarantee it aligns with your present threat direct exposure. Changing coverage degrees and timing of purchases can assist optimize your danger protection strategy. By following these ideas, you can you can look here maximize the advantages of LRP insurance policy and secure your livestock operation versus unexpected risks.

Verdict

In conclusion, animals danger defense (LRP) insurance is an important device for farmers to manage the monetary threats connected with their animals procedures. By understanding how LRP works, eligibility and protection alternatives, along with the advantages and disadvantages of this insurance policy, farmers can make enlightened choices to protect their resources. By thoroughly thinking about LRP premiums and applying strategies to maximize advantages, farmers can minimize possible losses and ensure the sustainability of their operations.

Animals producers interested in getting Animals Threat Defense (LRP) insurance can check out a variety of eligibility standards and coverage options customized to their specific livestock operations.When it comes to protection choices, LRP insurance coverage uses manufacturers the adaptability to pick the coverage degree, protection period, and endorsements that best suit their risk management needs.To understand the complexities of Animals Danger Security (LRP) insurance completely, comprehending the aspects influencing LRP insurance premiums is essential. LRP insurance premiums are figured see here now out by numerous aspects, including the coverage degree picked, the expected price of animals at the end of the coverage duration, the type of animals being guaranteed, and the size of the coverage duration.Evaluation and Readjust Insurance Coverage Regularly: As market problems alter, regularly review your LRP coverage to guarantee it lines up with your current risk exposure.

Report this page